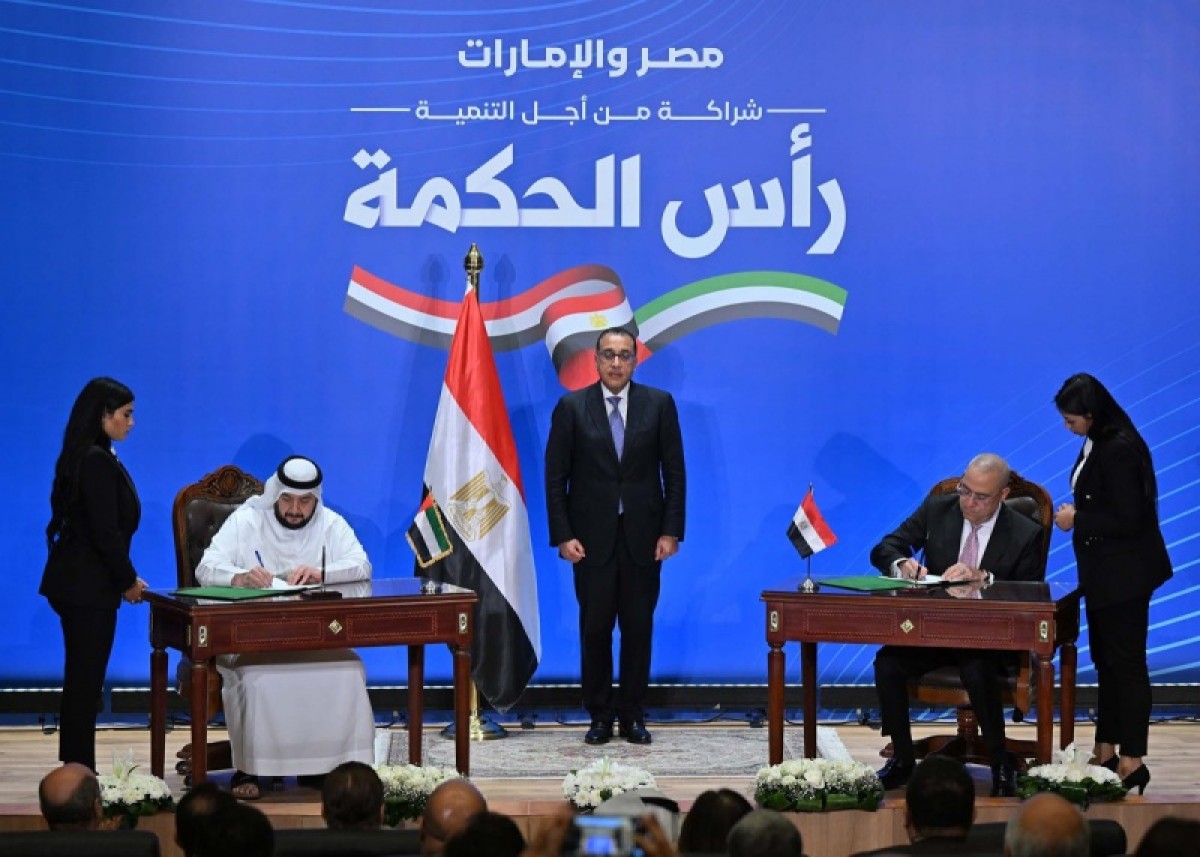

The largest direct investment deal between Egypt and the UAE

Egyptian Prime Minister Mostafa Madbouly announced on Friday that the UAE will pump “$35 billion in direct investments” within two months in debt-laden Egypt, which is experiencing one of its worst economic crises, with a scarcity of the dollar and a record collapse in the value of the pound.

He stressed that this dollar proceeds “will be used to solve the economic crisis and will contribute to solving” the problem of foreign exchange in Egypt, which finds it difficult to provide it to secure its needs for imports and pay its foreign debts amounting to 165 billion dollars, and in controlling the problem of “the presence of two prices for the dollar.” One of them is official in banks and the other is on the black market and is about twice the official price.

Madbouly explained that these investments will be pumped in accordance with an agreement signed on Friday between the Egyptian and Emirati governments to “develop 170.8 million square meters in the Ras El Hekma region” on the Mediterranean Sea in northwestern Egypt.

He continued, "After a week, $15 billion will come directly" from the Emirates, including $10 billion that will be transferred directly, in addition to $5 billion, which is part of an Emirati deposit with the Central Bank of Egypt, with a total value of $11 billion.

He added that the second batch of investment flows will be pumped after two months, “amounting to 20 billion dollars, including 6 billion dollars that is the remainder of the UAE’s deposit with the Central Bank.”

A tourist area, a marina for ships, and an international airport

He said that the total value of the project, which requires the establishment of an integrated city that includes a large tourist area and a marina for large cruise ships, in addition to an international airport that will be managed by the Emirates, amounts to $150 billion.

Egypt's foreign debts have more than tripled in the last decade to reach $164.7 billion, according to official figures, including more than $42 billion due this year.

The shortage of hard currency in the country prompted JP Morgan earlier this month to exclude Egypt from some of its indicators.

Moody's credit rating agency also lowered Egypt's outlook from "stable" to "negative," citing concerns about external financing and the difference between the official exchange rate and the parallel market.

The price of the dollar is currently about 31 pounds in the official market, while it reaches about 70 pounds in the parallel market.

The maturity of some foreign debts this year coincides with the disruption of navigation in the Red Sea due to Yemeni Houthi attacks on ships against the backdrop of the war in the Gaza Strip, which negatively affected the Suez Canal, whose revenues constitute one of the most prominent sources of foreign exchange in Egypt, and which declined by a rate ranging between 40 and 50 percent, according to Egyptian President Abdel Fattah El-Sisi.

Remittances from Egyptians abroad, which constitute the country's primary source of foreign exchange, in turn recorded a decline during the first quarter of the fiscal year 2023-2024 by approximately 30 percent compared to the same period of the previous fiscal year.

Egypt signed an agreement with the International Monetary Fund at the end of 2022 to obtain a loan worth $3 billion, but it only obtained the first tranche of it, amounting to $347 million.

The disbursement of the following tranches was postponed several times due to disagreements between Egypt and the Fund regarding the structural reform program and the Fund’s demands, especially for a flexible exchange rate and for reducing the share of the state and the army in the economy.

Finally, the International Monetary Fund announced that an agreement would be reached within a few weeks with Egypt regarding the first and second reviews of the loan agreement, which were postponed several times last year.